You Should Remember

The key objective of the accounting Cycle process is to collecting the required material that includes information, facts and figures to prepare a set of financial statements.

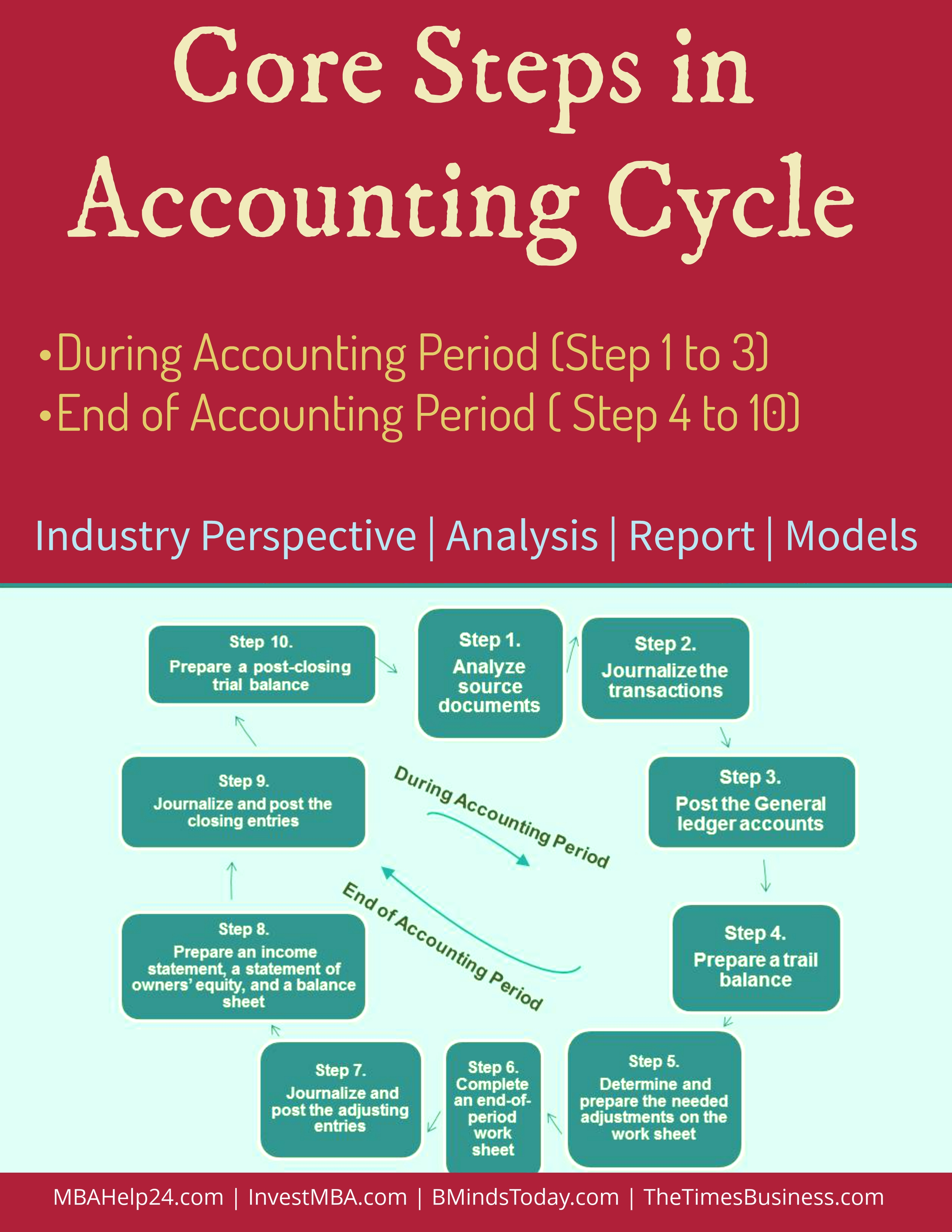

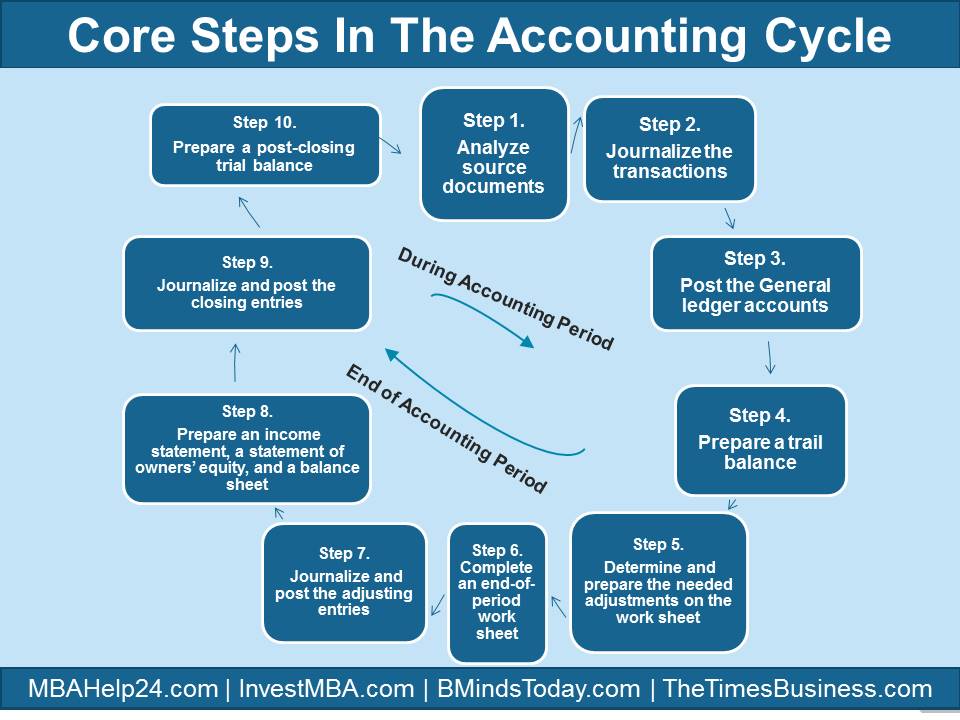

Core Steps in Accounting Cycle

It is a part of the practice that an accountant follows a series of necessity steps each period to prepare and adjust the financial entries or statements.

The key objective of this particular process is always to collect the required material that includes information, facts and figures to prepare a set of financial statements.

Together these phases make up the accounting cycle. The term originates from the fact that the steps are repeated each period.

The steps in the accounting cycle are shown in the following diagram.

The whole process of accounting cycle that involves several steps is fundamentally classified into two categories;

- During Accounting Period (Step 1 to Step 3)

- End of Accounting Period ( Step 4 to Step 10)

During Accounting Period (Step 1 to Step 3)

Keep it in mind that step one involves not only collecting information but also analyzing it.

Transaction analysis is probably the most challenging of all of the phases in the accounting cycle. It needs the aptitude to think logically about an event and its effect on the financial position of the entity.

Once the transaction is analyzed, it is recorded in the journal, as directed by the second step in the demonstration.

The first two stages in the cycle take place continuously.

Journal entries are posted to the accounts on a periodic basis. The frequency of posting to the accounts depends on two factors:

- The style of accounting system used by a corporation, and

- The size of transactions.

In a manual system, entries might be posted daily, weekly, or even monthly depending on the amount of activity, in a computerized accounting system, posting is likely finished automatically by the computer each rime a transaction is recorded.

End of Accounting Period (Step 4 to Step 10)

The “end of accounting period” phase starts from “trail balance” process, in which a trail balance is calculated to prove that the sum of the debts is equal to the sum of the credits. Following the trail balance phase, adjusting entries are made for accrued and deferred items.

Then the process of “adjusted trail balance” phase starts, in which a new trail balance is calculated after making the adjusting entries. Consequently the financial statements are prepared. From then on the focus shifts to “closing entries” phase, in which it transfers the balances of the temporary accounts. Finally, a trail balance is calculated after the closing entries are made.

The above discussed steps are involved in accounting for all the business activities during an accounting period. The accounting cycle at all times initiates with the analysis of source documents and finishes with a post-closing trail balance.

Concept & Definition of Accounting ?

Characteristics of Accounting ?

Key Differences Between Accounting & finance ?

basis of accounting: Cash Basis & Accrual Basis ?

Fundamental Financial Accounting Assumptions, Principles & Conventions

Core Steps in Accounting Cycle | During & End of Accounting Period

4 Financial Statements | Balance Sheet | Retained Earnings | Cash Flows

The Balanced Scorecard | Comprehensive Knowledge | Measures | Perspectives

Capital Budgeting | Definitions | Features | Process | FIVE Stages

Capital Budgeting Decisions | Criteria | Substitute Directions | Implications

Liquidity Ratios | Current Ratio | Working Capital Ratio | Quick Ratio

Financial Leverage Ratios | Debt | Total Assets | Equity | Times Interest Earned

Profitability Ratios | Gross Profit Margin | Return On Assets | Return On Equity

Dividend Policy Ratios | Dividend Yield | Payout Ratio | Key Procedural Aspects